Conversion Reveals Source Viability

Cume is a typical metric by which we can judge the reach of a given media source. In the context of our study, cume is the total number of people who use a given media type. However, it does not tell the whole story. A lot of the headlines you see detailing the major findings of studies from ‘prestigious’ research firms are only really going as deep as ‘cume’. While helpful in determining the overall reach of a particular source, it does not demonstrate that source’s frequency of use. In our State of Media 2025 report, we apply the metric of conversion to our findings to reveal a medium’s true viability – and a few eyebrows were raised internally at Crowd React Media when reviewing the findings.

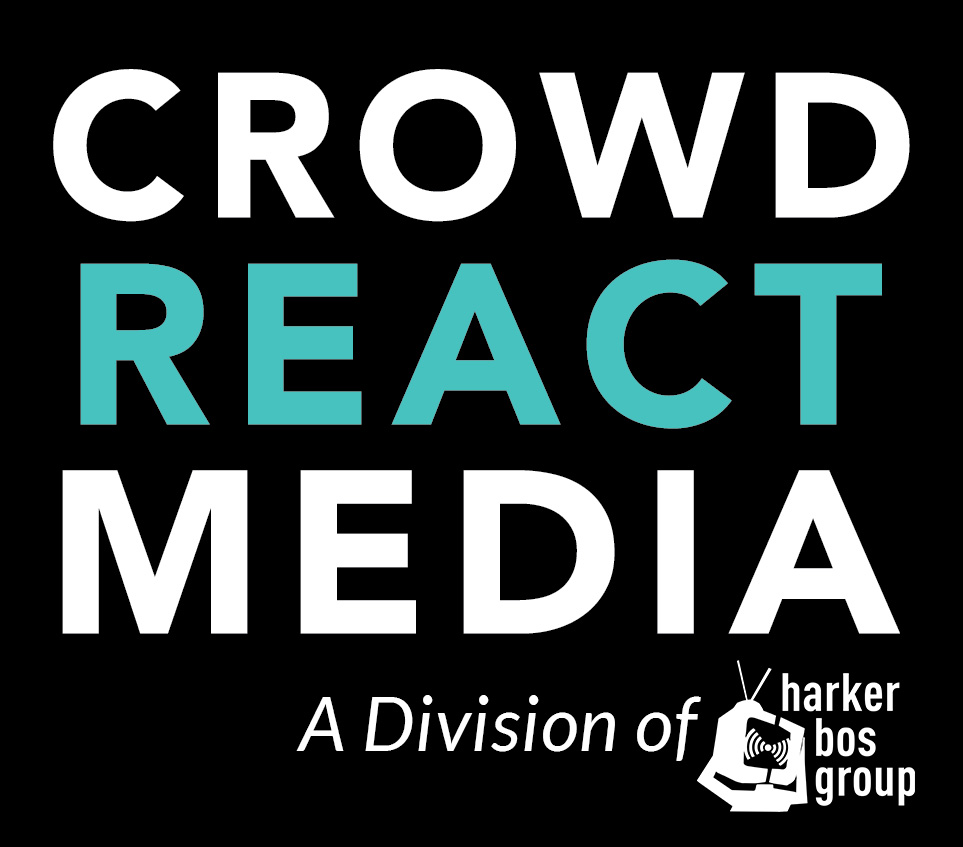

Before getting into our big surprises, let’s dive into overall cume for the various media types surveyed in our keystone report. Here is a descending list of media sources with highest cume at the top:

2025 Total Media Cume

Social Media: 90%

Streaming TV: 84%

YouTube: 83%

Radio: 76%

News Media: 72%

Music Streaming: 69%

Cable/Satellite TV: 64%

Videogames: 59%

Podcasts: 51%

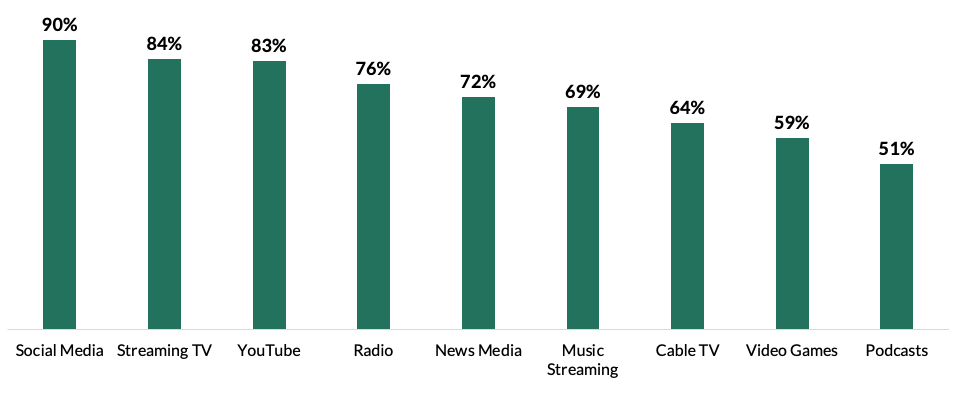

The above numbers reflect conventional wisdom about the viability and performance of today’s major media technologies. However, when applying our conversion metric, the picture gets a little shaky. We define conversion as the percentage of frequent users of a given media source divided by that source’s total cume. Conversion is otherwise the percentage of a media source’s total audience that frequently uses said source. When the preceding cume list is adjusted for conversion rates, there are a few surprises:

2025 Media Conversion

*Cume presented in parentheses

Social Media: 78% (90%)

Streaming TV: 72% (84%)

Cable/Satellite TV: 71% (64%)

YouTube: 59% (83%)

Music Streaming: 56% (69%)

Videogames: 50% (59%)

News Media: 45% (72%)

Radio: 40% (76%)

Podcasts: 32% (51%)

That Social Media and Streaming TV being top of the conversion list with highest levels of frequent use (and the largest cumes) comes as no surprise. However, Cable/Satellites’ comparatively high conversion rate (71%) is contrary to many narratives all but declaring the death of linear TV. Despite a somewhat lowered total cume, Cable/Satellite TV audiences are still watching a good amount of linear TV. If someone states they still watch Cable/Satellite, chances are they are watching Cable/Satellite a lot (hence the high conversion rate). This perhaps reflects a slowing rate of cord cutting overall.

Perhaps most notable on this adjusted conversion list is Podcasting. Podcasting has gone through many iterations in recent years, and at this point essentially suffers from a definitional crisis (video podcasts, anyone?). The most recent industry definition of ‘Podcasting’ seems to incorporate one or more people talking into a mic in a room and it may be filmed, or it may not (this meets the definition of most daytime TV, hence the definitional crisis).

Getting back on track

Media industry insiders consider Podcasting as part of the ‘legacy media’. However, our research shows that it has potentially plateaued. This is potentially due to a combination of reasons (e.g., stabilization of media use post-pandemic, return to a new normal, etc.). 32% of podcast consumers reporting frequent use betrays finite growth of a medium previously touted to dominate audio-based media types. Podcasting has some work to do after a return to earth from skyrocketing consumption rates during the pandemic years. For comparison, in 2024, Podcasting sat at 36% conversion and 58% cume.

Similarly, the State of Media 2025 has some red flags for Radio. As it stands, Radio enjoys relatively high cume but also carries the second lowest conversion among its audience (40%). We at Crowd React Media think that Radio is generally a stable medium. However, radio needs to adapt to meet consumers where they are. Habituated media behaviors among the state of media audience are centered around their phones and Smart TVs. Radio is in danger of being left out entirely if they do not act quickly. The challenge is to position your product that meets consumers where they are. Turning the dial and cycling through presets are not established audience routines in the way they were in 90s, 2000s, and even 2010s. Radio needs something else, because audiences are not really tuning the dial when they hop into their EVs. They are plugging in their smartphones.

This has been Volume 1 of our State of Media: 2025 Blog Series.

I am Sean Bos and it has been a pleasure.

To next time!